Timing Solution Wish List

e-Mail: Sergey

.

Date 04th 2007f April 2007

Planetary hours - fast algorithm

e-Mail: Patrick

.

Date 04th 2007f April 2007

Hi Sergey - like the Phenomena module as it\'s a good visual \"bar ruler\"...

A) However wonder if we could have an option to reduce the size

of the panels as they take up a lot of trading space. plse find attached.

B) Have a Harmonic option for the \"Planetary Position In Mundo\"

as ULE SuperSearch.

e-Mail: Rob

.

Date 04th 2007f April 2007

Hi Sergey,

Is it possible ( or worth it) to introduce an �Elliot Wave� function?

� Labelling Points 1,2,3,4, & 5.

� EBOT (Elliot Wave Break Out Point � to purchase)

� A Risk to reward function

Regards Robert

e-Mail: Rob

.

Date 04th 2007f April 2007

Hi Sergey,

Could we have an explanation (TS Article) on the \"128\" and examples of how to use it?

Maybe Yuri could give some additional recommendations

Regards Robert

e-Mail:

.

Date 04th 2007f April 2007

Hi Sergey

I use this indicator in Metatrader 4 ( lets call it \"XYZ\" for this posting). It is, I suspect an improved version of \"Judy MacKeigan\'s (Buffy)\" \"B Line\" indicator, but better. I\'ve found it very good over all timeframes on Forex Pairs, Gold and Share CFDs offered on the Metatrader platform. But its limited only to stocks offered on MT4. I\'ll send you the MT4 script and screenshots to view.

Thanks

e-Mail: Artemiss

.

Date 04th 2007f April 2007

The ability to see the diurnal chart when clicking on the current or past price history. Thanks. Artemiss

e-Mail: Anthony Tsousis

.

Date 05th 2007f April 2007

Sergey, The tools,phenomena, decans in ULE as an ingress point as well as the current colored display for the whole period in the decan. Regards Tony.

e-Mail:

.

Date 06th 2007f April 2007

Could you please integrate the Gartley pattern in the indicators ?

e-Mail: Peter Tryde

.

Date 08th 2007f April 2007

Sergey, your software is truly marvellous!

However, would greatly appreciate it if you would fix the following:

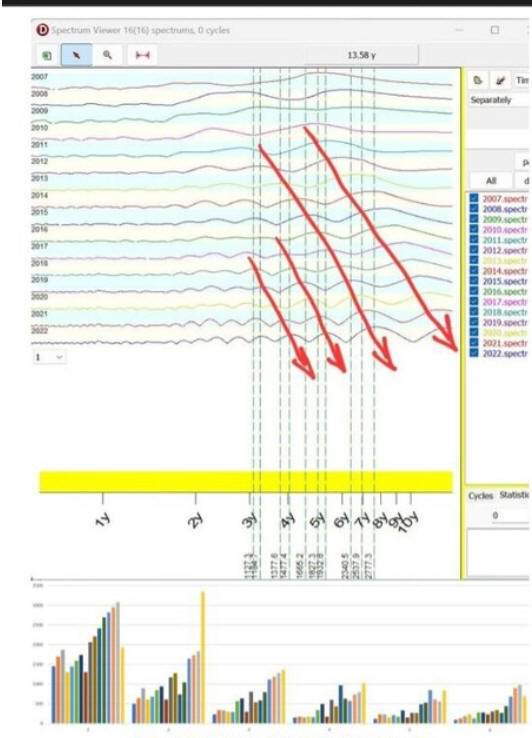

1 - In spectrum analysis under Point Astronomical Cycles there are

no settings for 10th and 11th Harmonic. All the others are there.

2 - Also in spectrum there are only 2 choices \"ORB\" or \"RPO\". Would it be

possible to include a few more like MA, MACD?

3 - In Astronomy under \"Context\" where you can input settings for

planets, aspects, middle points etc, it seems the \"save to file\"

function doesn\'t work. At least it doesn\'t in my program. I click

on the bottom and nothing happens.

4 - Is it possible to increase the strength of the projection lines? The

default colour is red and when printed out against the background of the

red testing area it gets very hard to see. There is a feature where one

can thicken the bars in the barchart. Could there be a similar feature

for the projection lines?

Many thanks for your help.

Peter

e-Mail: Sergey

.

Date 08th 2007f April 2007

Non Lag double filtered MA

e-Mail: al martin

.

Date 11th 2007f April 2007

Sergey,

I would like to see an option of a Calendar like listing for a user defined time period from 1 month to 1 year in which Composite Astro information could be displayed along with transit and progressed aspects to predictable zones. I would display the aspect the time frame 1-3 day exact (conj. opp. sq. tri. Declination parallels and contras antiscia, etc.) and the PZ by degree 220 - 225. That way the user could monitor the convergence of important Astro cyclesat the prdictable zones at a glance.

Also, maybe I have missed this information but when I run an astrological report I don\'t get the predictable zones placed in the report. I only see it on the scree in the composite area if I click on it. Let me know if I have overlooked something.

Tx

Al

e-Mail: Sergey

.

Date 16th 2007f April 2007

DB Delete file (Paul)

e-Mail: Patrick

.

Date 17th 2007f April 2007

2) Hi Sergey - Could we have a No. Harmonics option for

\"Planetary Position In Mundo\" for the \"Phenomena\" module.

ps narrow panel works well... Thanks Patrick

e-Mail: Alex

.

Date 19th 2007f April 2007

The possibillity to export data in tick format

e-Mail: Kenneth

.

Date 05th 2007f June 2007

Hi Sergey,

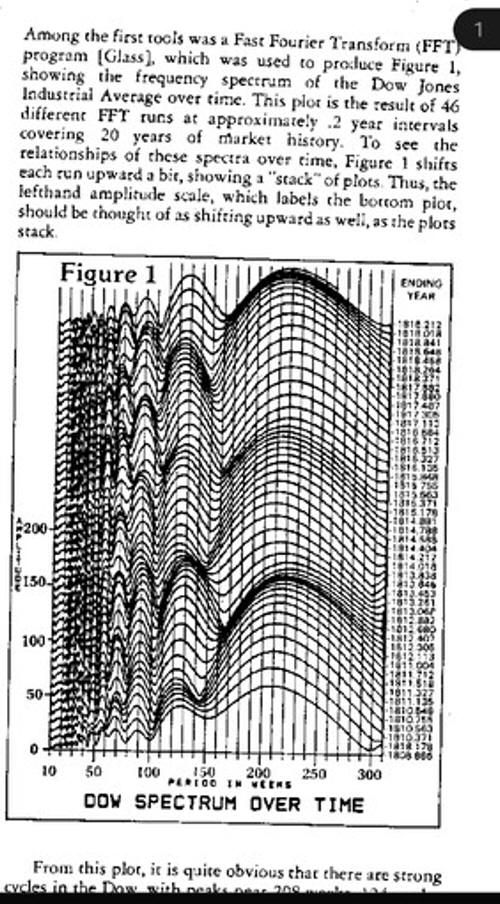

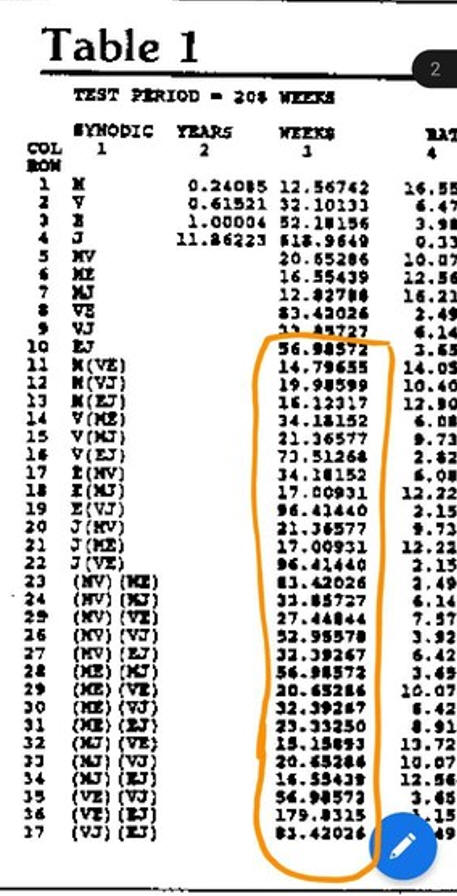

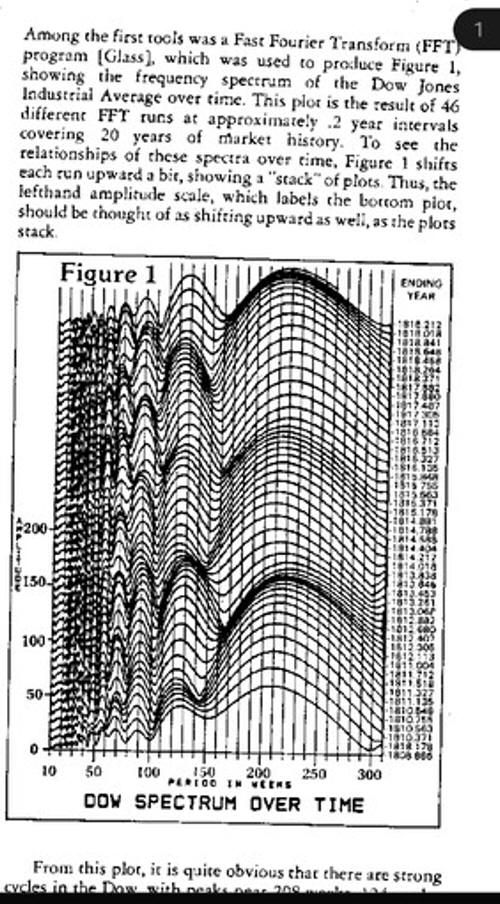

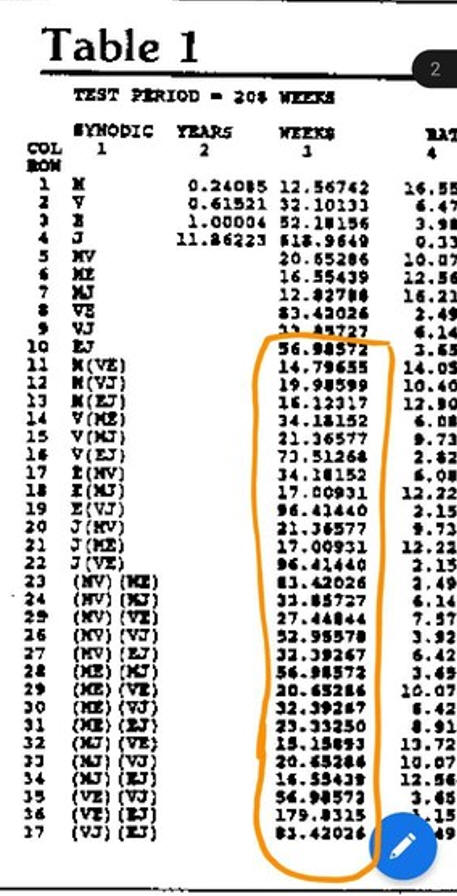

I came across a paper mentioning about research in cycles. It uses the basic synodic cycles of the planets including:

Mercury =12.56742 weeks

Venus =32.10133 weeks

Earth =52.18156 weeks

Jupiter =618.9649 weeks

Etc.

Then it goes on with the two planet combinations:

MV =(period of M x period of V)/(period of V- period of M) =20.65286 weeks

ME=16.55439 weeks

MJ=12.82788 weeks

Etc

These are all calculated in TS\'s astronomical module.

Then it goes on with the three planet combinations:

M(VE) = period of M x period of VE/ (period of VE - period of M) =14.79655 weeks

M(VJ) =19.98599 weeks

Etc

Then it goes on with the four planet combinations, (group of two by two):

(MV)(ME) =83.42026 weeks

(MV)(MJ) =33.85727 weeks

I wonder if TS can include such combinations in the astronomical module so that one that test if these combinations has any effect to drive the markets.

Regards,

Kenneth

e-Mail: Ramil

.

Date 07th 2007f June 2007

Привет, Сергей!

Возникла одна идея, которой хотелось бы поделиться. Я походил по форумам для трейдеров с одной целью: выяснить, чего больше всего хотят те трейдеры, которые проявляют интерес к финансовой астрологии. Какие индикаторы пишу для себя, какие вопросы задают, и т .д И тут у меня меня появилась идея, которую можно было бы реализовать в программе (или может быть в отдельной программе) в каком-нибудь обозримом будущем.

Выяснилось, что основные запросы потенциальной клиентуры как правило очень простые, и как правило их интересует 1) как отражается на рынке некий астрологический феномен 2) и как провести бэктэстинг этого феномена в отношении выбранных рынков.

Бэктестинг у нас есть, но здесь требуется что-то более простое. Если коротко, то что я предлагаю сделать, можно назвать \"упрощенным бэктестингом астрологических (и может не только) аргументов\". Например - мы закладываем в бэктестинг для проверки следующее утверждение (беру чисто с потолка): \"когда Венера в термах Венеры и Юпитера - покупаем, когда в термах Сатурна и Марса - продаем\". И далее смотрим, что будет с нашей условной 1000 долларов при вложении в различные инструменты. Принципиальное отличие в том, что коэффицент корреляции нам не столь важен, - нам важно, сколько мы вложили вначале, и во что превратиться эта сумма в конце. Нейросеть мы тоже не задействуем. Весь процесс бэктестинга сводится к двум простым действиям: мы просто тупо покупаем при одних (астрологических или других) условиях, и тупо продаем при других. Т. е весь набор астроаргументов мы разводим по двум секциям - на одних срабатывает команда на покупку, на других - на продажу. И потом уже в конце суммируем что получилось. Т.е то же самое, как во всех трейдерских программах.

Мы конечно можем рассмотреть работоспособность этих аргументов с помощью модуля ULE, но его явно недостаточно - там задействован визуальный анализ, а этого мало. Я смотрю на график - здесь цена поднялась, там упала, затем опять поднялась, потом идет боковик... Общая картина, однако, не совсем ясна. То же и с тестом на эффективность - он дает только статистические выкладки, что дает лишь приблизительную картину. Т.е он говорит нам (примерно) что \"цена упала в 56 процентах, и поднялась в 44\". Не говоря уже о том, что далеко не все можно проверить на тесте на эффективность - ту же Венеру в термах там уже не проверишь. Но поскольку я (условно) трейдер вкладывающий на рынок свои кровные, мне хотелось бы знать более определенно, что произойдет с моей тысячей долларов, если я вложу их на тот или иной рынок, при тех или иных астрологических условиях. Чтобы появилась таблица, и там было четко написано - рост или падение активов на такую-то величину. Представляется, что \"упрощенный бэктестинг астро-аргументов\", в том виде что я предлагаю, мог бы стать \"окончательным\" арбитром, чтобы понять насколько работает тот или иной аргумент. И уже затем те аргументы, которые лучше всего себя проявили, мы включаем в нейромодель, и вновь ее подвергаем (обычному) бэктестингу.

Но изюминка в том, что наверняка есть астрологические аргументы, которые на тех или иных рынках работают просто несокрушимо. Т.е достаточно найти их с помощью этого инструмента, и затем можно торговать (ох уж, эти мечты трейдера!), просто заглядывая в эфемериды :)

Если возьмешься, думаю, там должно быть как можно проще - в первом окне вводим из ULE аргументы на покупку, во втором - на продажу, в третьем - сумма, которую я вкладываю. И потом возникает итоговая таблица :) Плюс еще и в том, что вычислений там минимум, бэктестинг будет работать очень быстро.

Конечно, все это отличается от нынешней идеологии TS, но факт в том, что подобный анализ очень востребован, и ничего подобного на рынке нет. Существенно и то, такой подход очень понятен для трейдеров, которые работают с Метастоком, и прочими программами - мы тут не изобретаем велосипед, а делаем что и во всех программах, просто в качестве аргументов для тестинга предлагаем астрособытия. Поскольку нас есть гениальный блок ULE, формулы которого так и просятся в основу этого модуля.

Ну в общем, такие-вот выкладки, это все на перспективу, если будет время, конечно.

Рамиль.

ПС. Уж извини, не успел ты вернуться из отпуска - а тут и я со своими идеями.

e-Mail: Anthony

.

Date 08th 2007f June 2007

Hi Sergey, Greetings, its been a while.I hope you are happy and

well.I must say the software is outstanding and does almost everything you

could want,but as usual a request to make it better.After a long period of

research I have stumbled across some more Gann techniques from tunnel thru

the air.He has a bunch of gadgets and these are of course planets

interacting,he uses single/two and three planet combinations,for eg Mars at

8 degree stepping, both helio and geo for 1 planet,than say Jupiter/Saturn

at 11 deg geo or helio and finally, a 3 planet combination of eg Helio Earth

minus Mars plus Venus ie take the longitude of Earth then subtract the

longitude of Mars or vice versa (whichever yields a positive number} then

add the longitude of Venus and the result in 17 deg increments produces

turns in commodities.Could you please consider this as an innovation for

T.S. and include a 3rd window in the planetary timing module to allow

this,or is it too horribly complicated ? I hope not ! All the Best Tony.

e-Mail: Kenneth

.

Date 08th 2007f June 2007

Hello Sergey,

I\'m playing around with the charting module in TS. I noticed that the price axis changes automatically with the price range. I wonder if one can fixed the price scale, i.e. the maximum and minimum value of the price can be set so that one can maintain the ratio of price to time. The slope of the price line with respect to time could be studied. Please advise.

Regards,

Kenneth

e-Mail:

.

Date 08th 2007f June 2007

Test

e-Mail: Kenneth

.

Date 12th 2007f June 2007

I found that in the planetary lines analyser of TS, there is a choice for choosing helio latitude or geo latitude for transiting planets. I would suggest this can be added to the astronomical module so that we can test it.

e-Mail: Sanjay

.

Date 17th 2007f June 2007

Further THE LINE DRAWING TOOL Shows the DEGREES that the line is at. As we rotate, the degree changes. When we leave it and go back by clicking on the line, we only get LINE TYPE and color. Can you please ADD a box that would show what ANGLE the line is currently at and then that BOX can take user input for changing the ANGLE.

e-Mail: Gherardo

.

Date 26th 2007f June 2007

One think more about the saved worksheet, you know I save them with the porpouse to save time avoiding to recreate all the chart, what about the possibilit� to save time calculating the planet position for the new data,what I mean I suppose that if you save the chart you can save as well the planet file at that moment couldn�t the processor when you open the saved chart simply add the new planet position for the new days added, I suppose in this way is possible to save time

e-Mail: lesovikov@yahoo.com

.

Date 28th 2007f June 2007

Приветсвую , Сереж

Один из лучших и удобных отечественных поставщиков - бсплатных - по форексу+ золото и еребро - Форексайт через программу QuoteRoom

Совместимость с программами теханализа

Любая программа, которая может получать котировки от DBC Data Manager (поддерживается протокол Signal, протокол eSignal не поддерживается) или по DDE, может получать котировки и от QuoteRoom. QuoteRoom может выступать в качестве источника котировок в реальном времени для таких программ технического анализа, как

* Omega Research ProSuite 2000i;

* Omega Research TradeStation 2000i;

* Equis MetaStock 7.0;

* Equis MetaStock 6.52;

* DBC Signal;

* Ensign Windows.

http://www.forexite.com/default.html?31

Если бы помимо протокола e-Signal можно было бы добавить и протокол DBC , то в TS был бы решен вопрос с бесплатным потокам данных по валютному сегменту рынка

Всех благ тебе

Сергей

e-Mail: lesovikov@yahoo.com

.

Date 01st 2007f July 2007

Приветсвую , Сереж

Есть небольшая неточность в лунных днях ULE

Программа к примеру дает 19 лунный день на 01.07.2007,

но на самом деле на этот день календаря приходится 16-17 л д

http://www.moygoroskop.com/mooncalendar/mooncalendar/

Всех благ

Сергей

e-Mail: lesovikov@yahoo.com

.

Date 17th 2007f July 2007

PS

Продолжаю вести ветку в Х-Трейде

http://www.forum.x-trade.com.ua/viewtopic.php?t=679&start=180

(благо время есть - работу в Киеве найти по моему направлению пока трудно)

Судя по посещению - популярность очень высокая

Потихонечку совершенствуюсь

Да - и в понедельник стал приемным дедом :)

Сергей

e-Mail: Sergey

.

Date 19th 2007f July 2007

Planetary calculations: save into file and download next time to make calculations faster.

e-Mail: Peter Tryde

.

Date 19th 2007f July 2007

1 - Astronomy (Composite) The tick for \"Fast Access\"

doesn\'t stay.

2 - Astronomy (Composite) - Active Zones - CTX -

open file box \"read model\" cannot access previous events

files. This can only be done under NN. I feel this a flaw.

3 - Astronomy (Composite) - Active Zones - Options

under Statistics - I always need to change the 3 default

settings you have provided. Can there be an option to set

ones own default settings?!

4 - Astronomy (Composite) the Optimization only gives two options:

RPO or ORB. Is it possible to include MA and MACD?

5 - Astronomy (Composite) - Active Zones - CTX - \"Speed difference\" -

1st panel can enter many planets/objects but 2nd panel one can only

enter 1 planet. The same goes for \"Towards/From\". Can the

2nd panel be expanded to accomodate more planets?

6 - I do not understand the meaning of \"smoothing orb\".

It is not in the help index. Would you mind give me the

definition, thanks.

7 - I am also unclear about optimized composite files

.cmss Where are they stored and how can I use

them?!!

8 - Ref below screenshot. When I press print button

it is only the upper part that is being printed, but not

the important lower part. How do I print the whole chart?

Thank you for your help.

Regards.

Peter

e-Mail: Peter Tryde

.

Date 19th 2007f July 2007

1. Profit and Loss. Seems one can only save the 1st page

and not all the other pages with review of all the

trades.

2. Price Event/up down/try 2% up is OK, however, try 2%

down does not work.

e-Mail: lesovikov@yahoo.com

.

Date 21st 2007f July 2007

Приветсвую, Сереж

В продолжении темы неурожайных годов

пример исследований , утверждающих, что жара была не основным фактором низкого урожая

http://community.livejournal.com/golodomor3233/7365.html

С

e-Mail: lesovikov@yahoo.com

.

Date 22nd 2007f July 2007

Приветсвую , Сереж

Обнародовал стратегию на основе твоей программы

http://community.livejournal.com/ru_traders/672021.html#cutid1

e-Mail: Patrick L

.

Date 22nd 2007f July 2007

Hello Sergey and group, sorry if this subject has been brought up before, but just wondering if you had ever heard of the \"Berg Timer\" and do you think it is significant? If so, how would one go about setting it up in TimingSolution software? I will quote from a pdf file that I downloaded from the internet a few months ago: \"The Berg Timer Method combines all the possible harmonics made by all the planetary positions. Whenever two planets are longitudinally equidistant from a third, a planetary harmonic exists....it doesn\'t matter at what angle, 61, 98, 56.3, 129.467, whenever two planets are equidistant from a third, a harmonic exists which has power to affect solar activity, Earth environment and you and me.\" He states that during these harmonic periods, the stock market is affected. If this method is as powerful as Berg says it is, then it would be nice to be able to set this up using a program like TS.

Thanks for your help,

Patrick L

e-Mail: Sergey

.

Date 26th 2007f July 2007

First to do:

--------------------------------

Hello Sergey:

Thank you for looking into my request. I just requested that a Text Box be available where when I click on a LOW or HIG, it should prompt me for an angle measurement that I can type in.

Currently, I have to select and then this window that you are showing pops up and i have to slowly drag to get the EXACT angle I want. Some times it works, but most other times I am off due to the resolution of the move (also dependent how far the mouse is from the anchor point).

I hope I am clear, else please let me know and I can send a step by step.

Thanx and Best Regards

Sanjay

----------------------------------

Hi Sergey,

I wish to report a problem when running the spectrum module. I have repeated the process for three times and the computer always hangs:

1. Open Solutions, then click Spectrum

2. In Spectrum Analyzer, I manually selected three cycles

3. Then I click the icon W, extract first 5 astro cycles

4. The program runs to about 72%, then it hangs.

Please find some screen capture I have done.

Regards,

Kenneth

----------------------------------

e-Mail: Sergey

.

Date 26th 2007f July 2007

Tibor stat

e-Mail: Sergey

.

Date 31st 2007f July 2007

Composite->ULE

e-Mail: lesovikov@yahoo.com

.

Date 01st 2007f August 2007

Приветсвую, Сереж

Касаемо статьи

http://www.timingsolution.com/TS/Study/Class_Comp/class_comp_prelim.htm

Идея вот в чем

Если взять идеализированную синусоиду, разделим цикл на четыре равные части

Первая - растущая в положит области осиY - здесь преобладают удары вверх (обозначим область знаком +)

Вторая четверть синусоиды - движение вниз в положительной области от оси Y- удары и вверх, и вниз(обозначим как +\\-)

Третья четверть - вниз в отрицательной области ( ниже 0 оси Y) - удары вниз (обозначение -)

Четвертая четверть - движение вверх ниже нуля по оси Y - удары и вверх и вниз (обозначим как -\\+)

Такое видение способствует лучшей адаптации

Предложение:

В Астрологии композит - активные зоны - скачки цен - возможно как то показать не фиксированный процент , а спектр с разными процентами ( следует только учесть, что на форексе процент существенно меньше)

Всех благ

Сергей

e-Mail: lesovikov@yahoo.com

.

Date 01st 2007f August 2007

PS

Эта идея подсказана с какого то сайта, посвященного теории струн

e-Mail: lesovikov@yahoo.com

.

Date 02nd 2007f August 2007

Приветсвую, Сереж

По поводу фундаментальных данных в TS

Посмотри индикаторы ширины рынка

http://www.parusinvestora.ru/systems/book_meladze/book1_gl8_p1.shtm

В свое время - до 2001го пока работали командой в Ин-те проблем управления - мы строили для росс рынка - прекрасно работало

Правда для построения нужен весь спектр акций ( брали из финама)

К сожалению - программка сбора данных - человека , который ушел в небытие с этой программкой (т е не умер , а просто повел себя неадекватно к команде) , я не имею возможность их собирать

Сергей

e-Mail: lesovikov@yahoo.com

.

Date 04th 2007f August 2007

Приветсвую, Сереж

небольшое предложение

Может стоит установить фильтр в блок Upcoming Events , отфильтровывая сигналы в период торговой сессии

Всех благ

Сергей

e-Mail: Mohsen

.

Date 09th 2007f August 2007

A simple EOD historical price downloader from Yahoo in the OPEN data file window will significantly ease/speed up the startup process for EOD traders, even if the process is not fully automatic.

e-Mail: Gherardo

.

Date 10th 2007f August 2007

Now I am working with the upcoming report , and as I told you already in my previous emails I have some problem/doubt.

Coming back to the point of having for one symbol just up upcoming events and for another just down upcoming events what does it mean that for that symbol only down events are relevant for a particular transit and all the up events are connected with other events like transit in the signs or other figures?

Tha�s possible obviously if the program does a correct analysis even it sounds strange.

Now another point what I would like to obtain for another report is a kind of rank for each planet,let say I want to know among the planets which one has more influence with its transits in turning points of a symbol.

Or transits in signs etc.

So I would like to see wich has the biggest influence on a symbol.

Let�s say Moon has with the filter set(3 times 70%....) produced 500 turning,

Mars 249

Juppiter 12(Ok it�s slow it�s just an example)

Then I can choose the first 1,2 or 3 and among them having the statistics of the main effects with other planets so

Mars Pluto 65

Mars Venus 37, at this stage is not important the position/aspect but only the effect(turning point) n order to know on which planet first ,couple later you have to focus, otherwise there are too many variables to consider.

Is it possible to implement it, if there is already something similar in TS can you help me to find the way?

e-Mail: Gherardo

.

Date 14th 2007f August 2007

have found in the meantime some bugs in the program so for your knowledge:

� When you use a report in the CE and you try to set the chosen parameters as default for the next time they are not set in memory.This also closing and opening the program doesn�t change.

� If you try to print directly a fast spectrum model(I think this was ,or maybe a projection line from CE astronomy, I have done it yesterday twice,but not sure now which it was), the program is crashing the machine and a reboot is needed, in particular the problem was coming I think because I set the white option on the colours, and tried to print, this because I wanted to avoid to consume coloiurs on the printer, about this it would be good to have an option for printing black & white, because not all the printers have such an option.So in conclusion there is a main error that is creating a crash.The printer I was using just if needed was a Canon Pixma 90.

e-Mail: Gherardo

.

Date 14th 2007f August 2007

I have various argument for you.

Ok first of all I have downloaded the new upgrade, and I have seen your cursor on the Upcoming event.

I suppose to have realized what you meant to do, in ant case I will expect your final explanations, but I have to tell you that I have tried again for example with coffee, I have here almost 36 years history, and during this period the price has gone up and down many times so with many swings.

The projection of planetary aspects for upcoming events was giving almost 90 percent down effects,and still is giving this even if I place the cursor at 75 % up.

So maybe is still a statistical problem or is due to some structural fact , so maybe in this case the planetary aspects are marking just down effects?

For example the ingress in the signs is quite equilibrated for the same symbol.

Awaiting your comment.

Well let�s go further:

Still there is the pending problem of the worksheet ,as you remember there is still the necessity to let the program to update the planet position only the new days after the saving , and not for all the days again in order to save time, but a part this I have already mentioned there is also a general difficulty to load the saved version updating the file,I mean from file, every time I have problems , so there is some bug in the program,and I prefer to load again the symbol and start again all the study because it seems almost impossible to load the files.

Ok another problem I have seen today on the Vista version,I don�t know if is the same on the XP one.

Let say I open NN module and try to extract the cycles and I say extract all, when I say ok in NN nothing is happening so the waves/files are not loaded.

The same problem is happening when I do the reverse :

Extract cycles, save them in a file, try to open it in NN,nothing is happening.

So this is the situation Sergey, a lot to do for you a think, if you need help let me know

Sergey I would like to see on TS if

possible a statistical report presented like a table about seasonality of a

symbol, let�s call Sun into signs.(But this can be extended to other planets

as well)

As from your example on Dow for CE where

you have the 3 intervals,in your example 40 years, I see with other symbols the

period is automatically reduced according to the history, but is it possible to

set it to other intervals,personalizing it?Ok this is another story let�s

follow

So for example you could have something

similar

Sun

|

|

Gen

|

Feb

|

March

|

Apr

|

May

|

June

|

July

|

|

|

|

10Y

|

+3,4

|

+2,8

|

-5,6

|

-3,0

|

5,6

|

|

|

Average

price variation for the period month/month so here Jan/Dec

|

|

|

%

|

60

|

55

|

-70

|

-65

|

75

|

|

|

% price was higher or lower

previous month

|

|

|

20 Y

|

+5

|

+4

|

|

|

|

|

|

|

|

|

|

65

|

58

|

|

|

|

|

|

|

|

|

Etc�

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

And then for the other planets, phases

or angles maybe you can add as well at the bottom lines according to the option

selected with the program, showing correlation or tuning of the selection with

the past(Maybe you can use a gradient colour to show the correlation/tuning)

Let�s say that is another way to

present what you called split criteria, but with some more quantitative

data.

I , like many others,need sometime to

have the data presented in a statistical report, so this is a good way to have

seasonal cycles under control, but with a starting point to be able to filter

the influence of planets/combination on your symbol.

Ok in any case this is just a starting

point/idea to be developed.

Maybe something similar is already in

the program, in such a case let me know how to reach it, or if not let me know

what you think about it.

e-Mail: lesovkov@yahoo.com

.

Date 16th 2007f August 2007

Приветсвую, Сереж

\"В ближайшее время в Симферополе откроется ПТУ, в котором ежегодно будут обучаться 120 астрологов.

Журавлева также отметила, что \"астрология на Украине впервые в мире признана наукой\"http://www.newsru.com/world/16aug2007/astrologi.html\"

e-Mail: Massimo

.

Date 20th 2007f August 2007

I like to make some tests with Spectrum

and then Harmonic Box

( that with the manual choice );

the small icon inside the spectro to sx of Excel icon.

well, is it not possible to save the jobs inside this window ?

e-Mail: lesovikov@yahoo.com

.

Date 22nd 2007f August 2007

e-Mail: lesovikov@yahoo.com

.

Date 22nd 2007f August 2007

Приветсвую Сереж

Из жизни России

Эпохальное восхождение

http://www.k2-8611.ru/blog/Lists/Posts/Post.aspx?ID=2

В свое время пригласили в гималайскую экспедицию - изза этого и влез в рынок

Правда сорвалось все на дефолте у меня...

C

e-Mail: lesovikov@yahoo.com

.

Date 23rd 2007f August 2007

Сереж - пожалуста - сделай полее подробное объяснение как

интерпретировать последние индикаторы

Русская переводная литература страдает недостатками в этой области

Всех благ тебе

Сергей

e-Mail: Gherardo

.

Date 25th 2007f August 2007

The problem I mentioned in a previous email about the import in NN was a mistake I did, so the program is working regularly.

While I have to confirm you the problem about the default settings in the report of CE if I click on default to set the parameters this doesn�t produce any effect even after of the restart of program, so let say I set 1234H, 0,2 correlation the next time I have to do it again.

Another problem I have found in the program is that if I use the annual cycles and they are projected regularly on the main window then is impossible to remove them, or at least I haven�t found any way to remove the curves from the window, neither from the panel of the drawings, neither clicking on them and trying to delete,neither there is a pop up menu to close this study,so can you arrange it?otherwise I am obliged to close the symbol and open It again.

I am trying to work on the cycles to extract some good model for the items I am trading, mainly commodities, still I have some difficulty to produce a good projection line based on cycles, while it seems better on astro.I have to ask you is it possible while NN is training to see somewhere the correlation that step by step is obtaining on the training period in order to know when is better to stop the training?Actually I am doing it visually but maybe there is such a possibility or if not it would be a great help to have it.

e-Mail: Gherardo

.

Date 25th 2007f August 2007

Header for printing

e-Mail: Gherardo

.

Date 25th 2007f August 2007

Header for printing

e-Mail: Mohsen (mkxy@yahoo.com)

.

Date 25th 2007f August 2007

Sergey,

We all know that Bradley Barometer is almost perfect with the reversals. It needs an NN though to optimize it and figure out the major reversals. The target can be confirmed by the turning point module. I think the combination of these two will be magical.

Thanks,

Mohsen

e-Mail: lesovikov@yahoo.com

.

Date 30th 2007f August 2007

Сереж - извини - небольшой , но важный вопрос.

Если я получаю результат в Upcoming Events , скажем на S&P - Большая часть сигналов приходится вне сессии.

Могу ли я их проецировать скажем на торговую сессию фьючерсов S&P в Глобексе (который идет круглосуточно)?

Почему спрашиваю - у меня пока нет данных с Глобекса , но есть вопрос , на который нужно сформулировать ответ.

Всех благ

Сергей

e-Mail: Al Martin

.

Date 31st 2007f August 2007

Is it possible to include Julius Bartels Statistic on cycle probability with the spectrum analyzer? IT would allow the user to select the cycles which are most probable, and it would provide the ability to create a composite cycle that should be predictive even without applying the neural net solution.

e-Mail: Massimo

.

Date 06th 2007f September 2007

Inversions in BT

e-Mail: Ian

.

Date 07th 2007f September 2007

I noticed on the Astronomy module, for Sun Geo 1H, it now shows the

current year rather than the 12 Zodiac Signs. I preferred seeing the

Signs, to be honest, although I can understand that some users would

prefer it this new way; can we have the option to choose?

e-Mail: Massimo

.

Date 10th 2007f September 2007

allow me a question:

this technique to

find possible TP with the use

of \" committee \";

perhaps; would it be

able to be improved using

the \"predictable zones\" as it happens

in

Astronomy model ?

it would not be a good utility for TS

e-Mail: unreal19@rambler.ru

.

Date 14th 2007f September 2007

Здравствуйте Сергей,

Я один из пользователей Вашей програмы (Русской версии - Timoshkin Mikhail)

Решил задать Вам вопрос, т.к. на нашем форуме активность не очень большая (http://fxforum.winm.ru)

Вопрос вот какого плана

Я сохраняю рабочие чарты в формате ***.wts (worksheet) - в них мои заготовки (нарисованы линии тренда, урони и тд.), затем открываю их через определенное время, но они не обновляються, в них последняя дата - на день создания, - как обновить данные в рабочих формах?? Если использовать \"add price data\" - там выбираю \"add from file\" - выбираю папку откуда данные (использую данные в формате Metastock) - нажимаю ОК - и ничего не обновляеться. Просветите pls., как обновить данные??

Да, попутно еще вопросы

Как можно получить (купить) real-time модуль

и какие форматы данных он поддерживает (например у нас все пользуються в основном Metatrader - для Forex и Metastock или Omega Tradestation для акций - есть ли поддержка таких форматов данных или там только платные поставщики (e-signal..... и тд.)

С уважением,

Михаил

e-Mail:

.

Date 14th 2007f September 2007

Have been using a natural intra-day cycle using Super Search ULE

with good success for some time now.

However...

Would like to use the NN to improve the projection line,

but the Angle Between (Value) does not have an Mundo option.

ie.

Neural Net Criteria Master (NN Inputs)

Astrology

Angle Between (Value)

Mundo (current options given are: Geo, Helio, Declination, Phase)

e-Mail: lesovikov@yahoo.com

.

Date 22nd 2007f September 2007

Приветсвую, Сереж

Тебе как математику, думаю , интересна эта полемика Горчакова

http://community.livejournal.com/ru_traders/732805.html?mode=reply

С

e-Mail: lesovikov@yahoo.com

.

Date 22nd 2007f September 2007

Download Area

EUR 60min Time GMT

format .prn

First date 12/16/1998

http://www.geocities.com/lesovikov/EURH.zip

e-Mail: lesovikov@yahoo.com

.

Date 22nd 2007f September 2007

Download Area

GBPUSD 60min Time GMT

first data 10/13/1998

format .prn

http://www.geocities.com/lesovikov/GBPH.zip

e-Mail: Patrick Lester

.

Date 30th 2007f September 2007

Everything that has to do with WD Gann:

Dynamic Gann Levels, Division of 3rd, Division of 8th, Dynamic Square of 9, Dynamic Gann Fan, Gann 90 Degree, Gann Box, Gann Single Degree Line, Gann Square Range, Gann Square Top/Bottom, Gann Squares, High Low Degree Angles, Price Division, Seven Times the Base, Static Square of Nine, Time Division of 3rds, Time Division of 8ths, Time Price Labels, Time Price Vectors, Zero Degree Angles, Zero Degree Line

I am currently demoing a program called \"Market Analyst 4 - Gann Analyst Edition\" and this is where I got the list of the above indicators. If you make a program devoted to Gann I will buy it.

Thanks,

Patrick Lester

e-Mail: lesovikov@yahoo.com

.

Date 04th 2007f October 2007

Приветсвую, Сереж

Предложение

Функцию из последнего обновления (для спектра) вынести в Timing Solution style - тогда и в Back Testing ее можно будет использовать , а то из-за того, что в интрадее (часовик и ниже) не выделяется спектр(только длинные периоды , но не самые высокие пики ) , не использую Back Testing в моделях интрадей :(

Всех благ

Сергей

e-Mail: Capt Randy

.

Date 04th 2007f October 2007

When you post a new upgrade to be down loaded, you have it as \"ts_upgrade\" or \" ts_beta\".

Could you add the date in front of it? Like, \"10-02-07 ts_upgrade \".

Now the reason being is that if you missed an upgrade or have already downloaded it you can see this before they click on download.

e-Mail: lesovikov@yahoo.com

.

Date 05th 2007f October 2007

Приветсвую, Сереж

Тебе было бы интересно

http://community.livejournal.com/astronomy_ru/85093.html?mode=reply

e-Mail: Randy

.

Date 05th 2007f October 2007

Now to the lighter side. Lets talk about Traders Strategy� there is two items I would like to talk about. The first is when you have a couple of lines in there and you wnt to use the SUM to sum them up, the Sum part takes for every to work. I�m not sure why but it takes it a long time to work and come up with a sum line.

e-Mail: Anthony

.

Date 10th 2007f October 2007

Hi Sergey,I was wondering if you could put arabic parts into ULE, The part

> of DOW is asc +Venus -Sun and asc+Sun-Venus.That way we

> can see transits to this posn either on a natal date or high or low date or

> rotational conjunction date,of course, if its not to difficult.Regard Tony

>

e-Mail: Peter Tryde

.

Date 10th 2007f October 2007

5 - The days in RPO can be adjusted. Would it be

possible to have the same feature for MACD?

When I optimize the days in TradeStation for the most

profitable trading of f. inst the Hang Seng Index the

days should be: 4, 12, 17 which is quite different

from the default setting in TS

6 - Square of 9 does not retain pattern angles or the

planets when saved. Also when changing the

font size the market cells and cycles disappear and

only the planets remain.

7 - Would you mind to add a print function under

Ephemeris.

8 - In Ephemeris - Vertical diagram - nothing changes

if one changes the Harmonic no. The Horizontal graph

does change whenever the Harmonic no is changed.

e-Mail: Massimo

.

Date 12th 2007f October 2007

always inclusive in the template:

possession the possibility to place side by side

possible oscillators in \\\" panel 1 , Panel 2 , Panel 3 ...\\\"

in a sort of \\\" stack panel \\\":

to understand us: in Advanced GET more and more

oscillators have not overlapped

but you can be skimmed through with a tongue

e-Mail: Antonio

.

Date 17th 2007f October 2007

there is some way that is possible to print the Efficiency Test results with the Event Information, Recommended Strategy and Summary ?

Best regards

Antonio

e-Mail: Al Biddinger

.

Date 18th 2007f October 2007

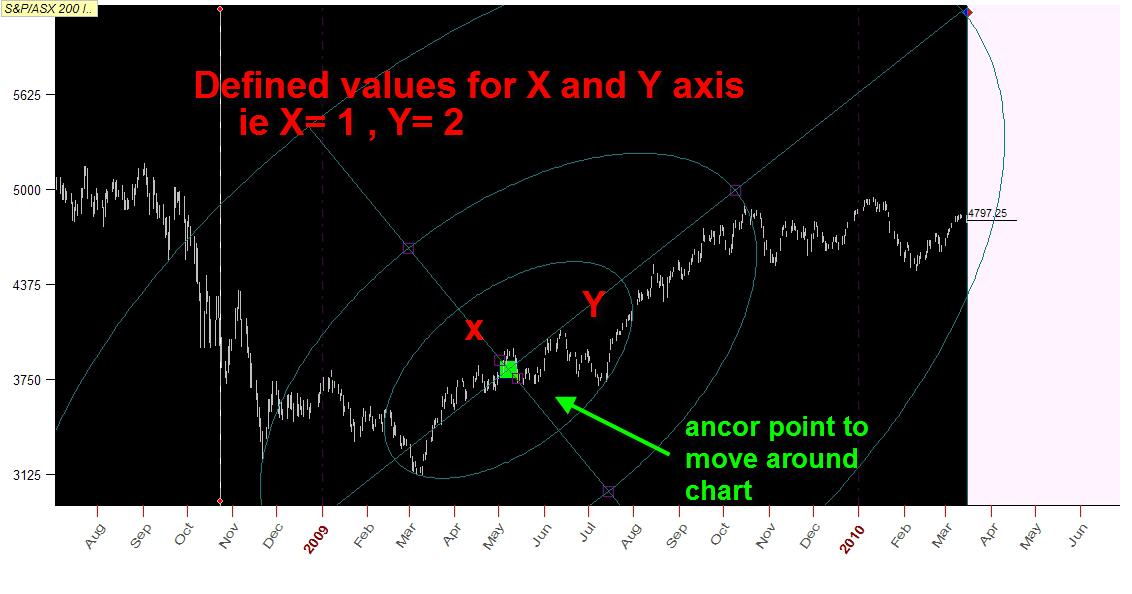

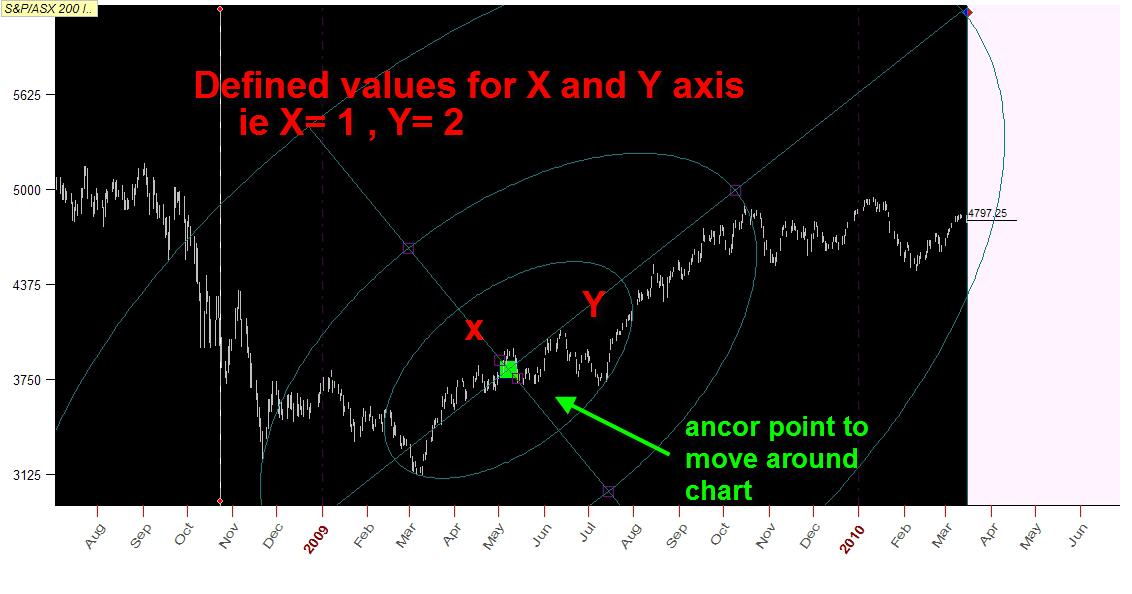

Several Questions:

1) Can you please add an option to the shape drawing tool to lock the ellipse in a circle?

2) Is it possible to generate Gann\\\'s zero angle lines (ie, we start a line from 0 price going up x points for y time, initiating each line from major highs and lows?

3) Can we specify a scaling factor for the charts (ie, x points per bar)?

Thanks in advance,

e-Mail: Scott

.

Date 19th 2007f October 2007

Thought I write this to you right now while it\'s on my mind.

In NN, I\'ve saved a set of RSI\'s that I like to use and just open

them up each time I am going to make a run. One thing is that it

doesn\'t save the colors that I\'ve set and I have to reset the colors

that I want each time. It\'s a small thing but rather annoying. Is it

possible to save the color information also?

e-Mail: Nick

.

Date 20th 2007f October 2007

Hi Sergey,

I have a question...why is it that after I save a natal that I have run and then re-load it, the natal does not load, only price data?

Nick

e-Mail: Robert Rundle

.

Date 20th 2007f October 2007

Hi Sergey,

Just to add to my reply on your �Questionnaire for Timing Solution Users� Q5) Any other suggestions/comments.

A good idea to add to �Easy Cycle� would be to add the $ Value to the Data panel (in Yellow at bottom right hand corner). As roughly illustrated in my picture below.

This would aid in taking the price value of a High or Low and counting out that many days for the next change in trend. Works well on some stocks.

Regards Robert Rundle

e-Mail: Massimo

.

Date 20th 2007f October 2007

b) if I open an existing model \\\" test12 \\\"

your procedure won\\\'t succeed in realizing a

new model, \\\" test15 \\\" but,

it will keep on saving that old \\\" test12 \\\",

what I had opened an instant before

a+b) you should distinguish these two functions

in the buttons of the form ULE:

new model, update model

( with some experience he works equal ..... )

e-Mail: Serg

.

Date 20th 2007f October 2007

CSV format

e-Mail: lesovikov@yahoo.com

.

Date 22nd 2007f October 2007

Приветсвую, Сереж

Обращаю внимание на сегодняшнее письмо в

tradingharmonically@yahoogroups.com

Собственно - єто вариант фундаментального фактора, который можно заложить в ULE:

Критерий Хинденбурга Омена (Hindenburg Omen),

предсказывающий финансовые катастрофы

http://en.wikipedia.org/wiki/Hindenburg_Omen

Всех благ

Сергей

Hi Sergey,

Just to add to my reply on your

�Questionnaire for Timing Solution Users� Q5) Any other

suggestions/comments.

A good idea to add to �Gann Fan� function

would be to;

-

If you re type a value into the

�Incline $/Day� panel for the fan to snap to this new value

-

Include / exclude fans (your

colored fans are very good idea)

-

Option to label fans

A simple risk / reward function over chart

(and time based) like in Hubb�s �Profit Source� Software (very freezey

program that uses Elliott Wave)

Regards Robert Rundle

I posted this before -

I use this indicator in Metatrader 4 ( let�s call it

"XYZ" for this posting). It is, I suspect an improved version of

"Judy MacKeigan's (Buffy)" "B Line" indicator, but better.

I've found it very good over all timeframes on Forex Pairs, Gold and Share

CFDs offered on the Metatrader platform. But its limited only to stocks

offered on MT4. I'll send you the MT4 script and screenshots to view.

It�s a �HILDA Indicator� (high Impact Low drawdown

A � or something like that)

I�ve sent you before some time back, but here it is

again. I would really appreciate this if you could do it. Alex Pushkin and I

have been trying to recreate it in wealthlab for 12 months now but are

unsuccessful. It would obviously just need re-naming to something else, and

copy write shouldn�t be an issue as it is still a modification of excising

style of indicator. It uses a �LEN� value in the script as its speed

variable.

Here�s a screenshot from MT4 AUSUSD showing turning

points / swing cycles using Hilda.

Blue = fast len = 7

Yellow = med len = 10

Red = long len = 42

and green zero line

Regards Robert & Olya Rundle

MT 4 Script =

#property indicator_separate_window

#property indicator_minimum -1

#property indicator_maximum 1

#property indicator_buffers 1

#property indicator_color1 DodgerBlue

extern int Len=10;

double hilda[];

int init()

{

SetIndexStyle(0,DRAW_LINE);

SetIndexBuffer(0,hilda);

return(0);

}

int start()

{

double C1, C2, C3, var14, var1C, var20,

var24;

int var6, var12, varA, varE, temp;

double arr1[], arr3[];

int arr2[];

ArrayResize(arr1,Len+1);

ArrayResize(arr2,Len+1); ArrayResize(arr3,Len+1);

for (int i=1; i<=Len; i++) temp=temp+i;

C1 = 12.0/(Len*(Len-1)*(Len+1));

C2 = (Len+1)/2.0;

C3 = Len*MathPow(C2,2.0)-2*C2*temp;

int limit, counted_bars = IndicatorCounted();

if (counted_bars <= Len) limit =

Bars-Len+1;

else limit = Bars - counted_bars;

for (i=limit; i>=0; i--)

{

for (varA=1; varA<=Len;

varA++)

{

arr2[varA] = varA;

arr3[varA] = varA;

arr1[varA] = Close[i+Len-varA];

}

for (varA=1; varA<=(Len-1);

varA++)

{

var24 =

arr1[varA];

var12 =

varA;

var6 =

varA + 1;

for

(var6=varA+1; var6<=Len; var6++)

{

if (arr1[var6] < var24)

{

var24 = arr1[var6];

var12 = var6;

}

}

var20 =

arr1[varA];

arr1[varA] = arr1[var12];

arr1[var12] = var20;

var20 =

arr2[varA];

arr2[varA] = arr2[var12];

arr2[var12] = var20;

}

varA = 1;

while (varA < Len)

{

var6 =

varA + 1;

var14 =

1;

var1C =

arr3[varA];

while

(var14 != 0)

{

if (arr1[varA] != arr1[var6])

{

if ((var6 - varA) > 1)

{

var1C = var1C / (var6 - varA);

for (varE=varA; varE<=(var6-1); varE++)

arr3[varE] = var1C;

}

var14 = 0;

}

else

{

var1C = var1C + arr3[var6];

var6 = var6 + 1;

}

}

varA =

var6;

}

var1C = 0;

for (varA=1; varA<=Len;

varA++)

var1C =

var1C + arr2[varA]*arr3[varA];

hilda[i] = C1*(var1C+C3);

}

return(0);

}

e-Mail: Sergey

.

Date 23rd 2007f October 2007

Porfiri house system

Some other ideas to make it

even more user friendly �

�

Able to overlay a second or third

series over the top. (multiple cycles). Ie from a high and low.

�

Change / adjust / fine tune the value

of daily cycle in top yellow box. See picture.

�

Can the price value (you just did)

show from the mouse movement straight away, not wait until you have clicked and

committed to drawing a wave? Once you have drawn one wave, and cleared it, the

mouse then follows price OK.

Regards Robert

Murrey Math

����������, �����

� ���� ���� , ��� �� [tradingharmonically]

������

��������� Myrrey - ���� ��� ��������� ��� �

���

��������� (������ ����� ��� ����� ���������)

-

�������� ���������� ��� � ��������� �� .

Myrrey ��������� ����� ; ����� ���������

��� ����� -

�� ������ �� ���� ������ ������

������������ :)

��� �������� �� � ��������� MetaStock(�� �������)

������� ���� ��������� Myrrey � ��������� (��

�������)

������ ������

��������� ���� �� ������� � ������

����������� �����

������ � ���������� �������

� ��������� ��� - Chaikin osc � Demand index

��� ���� � ���������, ������ Demand ��

����������������

������ ���� ����� � �� ��� ������������

������ �� ����

, � ��������� Demand ( � ��������� ����

�����������

������� ������� ��� ��������).

�� ������� ���� ������� ���������� Chaikin osc

�������� - ����� ����� ��� ������ �

���������(��� ��

��������� � �����+����� ����� ������

����������)?

���� ����

������ ���������

e-Mail: lesovikov@yahoo.com

.

Date 28th 2007f October 2007

Из маленьких удобств

При тестировании Neural Net - Stop - Diagram - было бы неплохо поставить кнопку увеличения : если счет достаточно длинный и приходится отлучится - лучший параметр виден относительно

Всех благ

Сергей

e-Mail: lesovikov@yahoo.com

.

Date 29th 2007f October 2007

Приветсвую, Сереж

Американский знакомый прислал интересную ссылку

http://www.djindexes.com/DJIA110/learning-center/

e-Mail: albiddinger@gmail.com

.

Date 01st 2007f November 2007

Sergey,

Thanks for the lastest Betaversion that allows precise positioning of the Gann fan, etc.

Can you now please include a method that allows us to scroll down to zero price in order to set these fans at zero? The up/down arrows at the right of the chart will not allow me to get down to zero on the chart which is really where I need to be able to anchor these fan lines (in addition to highs and lows).

Thanks very much,

Al

e-Mail: albiddinger@gmail.com

.

Date 02nd 2007f November 2007

1) Is it possible to \'scale\' the charts by providing a points per bar value? The chart would then expand/contract to match the specified value and would remain in that scale for scrolling backward and forward in time.

2) Can we print these charts in PDF format so that they can be exported to a plotter/printer that takes 36\" by 120 foot (max) paper rolls?

I am doing a LOT of hand charting of late and would really appreciate being able to print TS charts off to charting paper (with all overlaying studies printed too) in the proper scale.

e-Mail: Sanjay

.

Date 02nd 2007f November 2007

One follow up... Is there a Statistical calculator that would tell what the return would have been during the past periods? Sure, I can manually calculate them or eyeball the result, but a Statisctical analysis with number of trades, profit, profitable trade etc.... or perhaps that is in MT Platinum?

I will be back to you with what I find.

This is Gann's 'Master Price and Time' diagram which contains in essance

(graphically) all of Gann's main ideas behind how markets move harmonically in

price and time:

1) The 45 degree timing line (central line) and the 2x1 and 1x2 Gann Fan lines

above and below the 45 degree line (ie, "As Above, So Below" from

Tunnel Through The Air.

Note that the price action was resting on the 2x1 line at the left of the

square (strong bull market position). When price fell off this line, it

tested (and rested) on the 45 degree line. In general, when price breaks

above or below one of these lines, it will travel to the next line for

support/resistance;

2) Gann divided his circle into 1/8's and 1/3rds. Note the vertical

divisions of time into 8 boxes (1/8's) and the price divisions of 1/8

(horizontal lines). Intersection points of these vertical and horiztonal

lines will tell you high probability turning points (and the corresponding

price) of markets;

3) The figure 'Squares' the range, low or high price. ie, set the lower

left edge of the square on a low price. Make the height of the box 2 x

low (ie, square the low). The box will then be 'scaled' to show the

harmonic 2-d movement of the market in the squared-range of the low.

One other question: is it possible to alter TS to allow drawing tools to work

on the Indicators? I would really like to be able to draw trend lines on

an RSI plot. Presently, the drawing tools only appear to work on the

price chart (unless I've missed something which is likely given all the code

you've put into TS!) :-0

e-Mail: lesovikov@yahoo.com

.

Date 04th 2007f November 2007

Приветсвую, Сереж

При вычислении спектра при Metric: Price Bar

в графе Period Frame - max возможно, следует кроме дней и год ввести еще и bar

Всех благ

Сергей

e-Mail: lesovikov@yahoo.com

.

Date 06th 2007f November 2007

Сереж - имхо - неплохо было бы сделать в Traders Strategy (под значком суммы в верхней панели)- есть кнопка сохранения - еще бы кнопка открытия .

e-Mail: Sergey

.

Date 08th 2007f November 2007

Planetary time Spectrum->ULE

e-Mail: Sergey

.

Date 08th 2007f November 2007

Universalni time convertor

For ex: read data for London and save into NYS time

e-Mail: Al

.

Date 11th 2007f November 2007

Hi Sergey,

Is it possible to show planetary elongations in TS? I\'d like to plot max/min elogations of Mercury-Sun for example.

Thank you!

Al Biddinger

e-Mail: Sergey

.

Date 15th 2007f November 2007

NN in bar time

e-Mail: Al Bidinger

.

Date 16th 2007f November 2007

Sergey,

I have a HUGE favor to ask-- I\'m in a group of 2000 traders that are

looking to trade stocks.

While at the Las Vegas Trader\'s Expo today, I saw a method that is

ALMOST identical to your

composite cycle chart where confluent areas are highlighted. There

was one KEY difference, however.

Instead of selecting three cycle traces to determine high areas of

confluence, the method used ALL

traces in the data set and plotted the average of all the lines.

(Which TS does now). What\'s different

is the variance around the average trace was shown to help determine

the best regions of the cycle to trade.

Would it be possible for you to modify the composite module to show

the least squares tracing of ALL the cycles (which gives us the slope

of the market at each date (degree) along with a variance envelope to

show which regions of the chart have the highest probability of

winning trade?

This modification would be of HUGE interest to every one of the 2000

trading club members (hint hint) :-)

Many thanks,

Al

e-Mail: Peter

.

Date 16th 2007f November 2007

Hello Sergey,

Thanks to your excellent instruction materials

I am finally getting a good handle on how to

use all the functions of TS and really enjoy

using your program. As mentioned by another

user it is by far the most powerful analytical

program on the market today worth more than

your price.

The reason for writing is to ask you to kindly

clarify the following:

1 - When using Spectrum Committee your

instruction article suggests to open NN and click

on a red/yellow button next to 5 3 7 so the program

can create different fixed cycles. However, the red/

yellow button is not there anymore. Have I overlooked

it somewhere else in the program?!

2 - In your opinion what is the best number of over-

tones? You mentioned using a high number some-

where in your articles, but my experience is that

a smaller number is better.

3 - I have been trying to see if different settings of

the Learner\'s rate would produce better result, but

it seems the default setting may be the best.

Where can I read more about this?

4 - Under Standard - various indicators - what are

the inputs for User15 ? Is there a way we can

create our own indicators?

I have already put in the wishlist a request for an

MACD where the periods are adjustable. Hope you

have time to do it!

The only area still causing me difficulty is how to

interpret the backtesting results. Recently a test

gave 3 different preferred results. Would you have

time to comment on it if I send it to you?!

Regards.

Peter

e-Mail:

.

Date 20th 2007f November 2007

Hello Sergey,

This is probably a \'dumb question\' but I\'m wondering if it is possible to build neural net models where I can specify the coefficients in front of the different variables prior to optimizing the neural net.

Example: Suppose I wanted to build a model of planetary longitudes where I want 2* Moon + 1*Venus + 0.5*Mercury to be the predictive model.

How can I use TS to build this model prior to neural net optimization?

Thanks in advance,

Al

e-Mail: William Bordi

.

Date 21st 2007f November 2007

There\'s several additions to the trading programs I\'d like you to consider,

some makingvit easier to use and others adding to its computational /

prediction capabilities:

1. Most of the detrending possibilities are done by subtracting a price from

an exponential moving average, such as the 1-10-10 setting for creating a

relative oscillator. I suggest that you institute the INSTANTANEOUS

TRENDLINE (TR), invented by John Ehlers, as another option for the

detrending since it removes any cycle component in the data. Then the

oscillator would then be (Close- TR)/TR. The formula for TR is as follows:

Typ: Indicatorn Name: Instantaneous Trend Line

Inputs: Price((H+L)/2);

Vars:

InPhase(0),

Quadrature(0),

Phase(0),

DeltaPhase(0),

count(0),

InstPeriod(0),

Period(0),

Trendline(0);

If CurrentBar > 5 then begin

{Compute InPhase and Quadrature components}

Value1 = Price - Price[6];

Value2 =Value1[3];

Value3 =.75*(Value1 - Value1[6]) + .25*(Value1[2] - Value1[4]);

InPhase = .33*Value2 + .67*InPhase[1];

Quadrature = .2*Value3 + .8*Quadrature[1];

{Use ArcTangent to compute the current phase}

If AbsValue(InPhase +InPhase[1]) > 0 then Phase =

ArcTangent(AbsValue((Quadrature+Quadrature[1]) / (InPhase+InPhase[1])));

{Resolve the ArcTangent ambiguity}

If InPhase < 0 and Quadrature > 0 then Phase = 180 - Phase;

If InPhase < 0 and Quadrature < 0 then Phase = 180 + Phase;

If InPhase > 0 and Quadrature < 0 then Phase = 360- Phase;

{Compute a differential phase, resolve phase wraparound, and limit delta

phase errors}

DeltaPhase = Phase[1] - Phase;

If Phase[1] < 90 and Phase > 270 then DeltaPhase = 360 + Phase[1] - Phase;

If DeltaPhase < 1 then DeltaPhase = 1;

If DeltaPhase > 60 then Deltaphase = 60;

{Sum DeltaPhases to reach 360 degrees. The sum is the instantaneous period.}

InstPeriod = 0;

Value4 = 0;

For count = 0 to 40 begin

Value4 = Value4 + DeltaPhase[count];

If Value4 > 360 and InstPeriod = 0 then begin

InstPeriod = count;

end;

end;

{Resolve Instantaneous Period errors and smooth}

If InstPeriod = 0 then InstPeriod = InstPeriod[1];

Value5 = .25*(InstPeriod) + .75*Value5[1];

{Compute Trendline as simple average over the measured dominant cycle

period}

Period = IntPortion(Value5); Trendline = 0;

For count = 0 to Period + 1 begin

Trendline = Trendline + Price[count];

end;

If Period > 0 then Trendline = Trendline / (Period + 2);

Value11 = .33*(Price + .5*(Price - Price[3])) + .67*Value11[1];

if CurrentBar < 26 then begin

Trendline = Price;

Value11 = Price;

end;

Plot1(Trendline, \"TR\");

2. Okay, now for several possible additions to the price that can be

predicted. Usually it\'s the Close, C, or Midpoint, M, that people select for

creating their oscillator. Well I worked for a large hedge fund for years

and did studies on hundreds of trade executions and the price that we

executed at most often, over 80% of the time, was the midpoint of the day,

or M, which also best represents the average price of the day. So to reflect

the real price of the day it\'s usually M, which is the blackest part of the

chart anyway.

When M and C move in the same direction, I\'m happy to use C but when they

move in the opposite direction, the change in C might be something

sporadic/sudden that does not reflect the real price change. How then in

that case to figure out what price to use? I use this formula, the CONFIRM

PRICE since it arbitrates between the two prices to confirm them. You can

create a SINGLECONFIRM or DBLCONFIRM price if you really want to make sure

when you select using the Midpoint over the Close.

BP = (O-L); buyingpressure (a Larry Williams invention)

SP = (H-C); sellingpressure

If BP > SP then BPSPdir = up;

If BP < SP then BPSPdir = dn;

If BP = SP then BPSPdir = neut;

If C>O then OCdir = up;

If C C1 then Do;

If M0 > M1 then do: SINGLECONFIRM = C0; DBLCONFIRM = C0; End;

Else if M0 < M1 then do: If OCdir = dn then SINGLECONFIRM = M0;

If OCdir = dn and BPSPdir = dn

then DBLCONFIRM = M0;

END;

Else if M0 = M0 then do; SINGLECONFIRM = C0; DBLCONFIRM = C0; End;

End;

If C0 < C1 then Do;

If M0 < M1 then do: SINGLECONFIRM = C0; DBLCONFIRM = C0; End;

Else if M0 > M1 then do: If OCdir = up then SINGLECONFIRM = M0;

If OCdir = up and BPSPdir = up

then DBLCONFIRM = M0;

END;

Else if M0 = M0 then do; SINGLECONFIRM = C0; DBLCONFIRM = C0; End;

End;

If C0 = C1 then Do;

If M0 = M1 then do: SINGLECONFIRM = C0; DBLCONFIRM = C0; End;

Else if M0 > M1 then do: If OCdir = up then SINGLECONFIRM = M0;

If BPSPdir = up and OCdir =

up then DBLCONFIRM = M0;

END;

Else if M0 < M1 then do: If OCdir = dn then SINGLECONFIRM = M0;

If BPSPdir = dn and OCdir =

dn then DBLCONFIRM = M0;

END;

End;

This is the price I would use for the oscillator; instead of 1-10-10 for the

Close minus anexponential moving average (10), I\'d use this (ARB PRICE -

TR)/TR.

================================

2.5 Another two prices you should give the user the option of using for LONG

TERM predictions is the following two smoothed moving averages of very

special construction with very little lag, both developed by John Ehlers,

the expert of zero lag cycle indicators:

Filt = (Price + 2*Price[1] + 3*Price[2] + 3*Price[3] + 2*Price[4] +

Price[5])/12

Therefore, the equation for the zero lag FIR filter is

Filt = (Price + 4.5*Price[1] + 5.5*Price[2] + 3*Price[3] - .5*Price[4] -

1.5*Price[5] - 2.5*Price[6])/9.5

==============

Optimum Elliptic Filter - a great moving avaerage

Smooth = .13785*Price + .0007*Price[1] + .13785*Price[2] +

1.2103*Smooth[1] - .4867*Smooth[2]

Reduced lag version:

Smooth = .13785*(2*Price - Price[1]) + .0007*(2*Price[1] - Price[2]) +

.13785*(2*Price[2] -Price[3]) + 1.2103*Smooth[1] - .4867*Smooth[2]

And bythe way, by computing a MESA forecast of

===============================

3. MarketTrader has a problem in that when we load data from Yahoo, such as

30 years of Citibank data, we\'re stuck with big gaps int he price data

stream because of stock SPLITS. For any neural network model using a

relative oscillator, it will see this as an actual price change and will

spend most of its time trying to fit this large change, thus wrecking the

model. This is a BIG PROBLEM/ERROR. We need the program to have the ability

to adjust price data for splits.

==============================

4. Also, the prediction window is automatically set too large on

Markettrader. Give us the ability to set it for any amount we want, such as

the last year, by moving the cursor. And also, allow us to DROP OFF early

data from price files just by clicking a button, so that if I load in 60

years of DJI Dow Jones data and I only want to use the last twenty in the

models, all I have to do is adjust some paramters rather than create an

entirely new data set, andit just drops off that data.

==============================

5. MarketTrader has models available, but there is no description of what

they are, when to use them, how you folks have found them to work (for

instance if the model uses Neptune going through the signs, that should not

be used for modeling prices with very little data since you won\'t get too

much of the Neptune cycle, but people won\'t know this). So create a little

window where you click on the model name and you get a description and what

it\'s best used for etc.

===============================

5.5 The TARGET PREDICTION should also have the option of (1) predicting

ranges (because day traders should trade mostly on large range days) and

(2) price changes.

===============================

6. Richard Houck used mean tertiary progressions of STATIONS (ahead of the

natal data) for event prediction, and I have found it wonderful for event

predcitions. I want an option where I can get a vertical line produced for

mean tertiary progressed stations of moon, venus, mars, etc. plotted on a

bar chart. (I cannot get your time tunnel dates to match up with his or

Matrix software for this variable). This could be great for rectifications

and I predict for predicting price turn dates. I\'d use a different color for

each planet station that\'s progressed - red for Mars, Blue for Jupiter, etc.

==============================

7. New Option I want in the programs - a REGRESSION EXPERT (ex. Black Box

Expert, Neural Net Expert, Easy Expert, Statistic Expert, REGRESSION

Expert).

I want two models available - linear and log-linear:

1) price change = a X1 + b X2 + c X3 + ..... + where price change is in

form of daily change

2) ln (price change) = a X1 + b X2 + c X3 + ..... + where price change is

in form of C0/C1 (since you cannot take log of negative numbers)

The variables I want available are of two types -- either continuous or

(0,1):

Continuous Model:

X1 = angle between moon and sun

X2 = angle between moon and mercury

X3 = angle betwwen moon and venus

X4 = angle betwwen moon and mars

X5 = angle betwwen moon and jupiter

X6 = angle betwwen moon and saturn

(0,1) Model:

IF angle between moon and sun IS CONJUNCTION then X1 = 1, else X1 = 0

IF angle between moon and sun IS 45 degrees then X2 = 1, else X2 = 0

IF angle between moon and sun IS 60 degrees then X3 = 1, else X3 = 0

IF angle between moon and sun IS 90 degrees then X4 = 1, else X4 = 0

....

IF angle between mercury and sun IS CONJUNCTION then Y1 = 1, else Y1 =

0

...

IF angle between mercury and sun IS 45 degrees then Y2 = 1, else Y2 = 0

....

These selection options can be put in a table for selection purposes as you

already do when selecting what planets to uses, angles to use, etc.. For

instance they click moon in that they\'ll try to predict prices using just

the moon. They\'ll click all the other planets they want angles between with

the moon to check out their significance. They click the model type so we

know it\'s a 01- or continuous model. If it\'s a 0-1 model type, they need one

more page to click the angles you want 0-1 variables set up for, and any

other astrological events.

I want (0,1) variables for the following events for the day: apogee,

perigee, eclipse, conjucnt the planet\'s node (Steiner Anthroposophy

astrology uses this), opposite the planet\'s node, fastest day, slowest day,

retrograde, direct, (retrograde/direct via all coordinate systems including

geo latitude, right ascension, etc. as per Michelson\'s list), max/min

declination, equinox, solstice, moon rises before sun/moon sets before sun

(Akkadian astrology uses this), sign ingress.

This opens up a whole new field of exploration if you give us many events we

can put in the model as a 0-1 variable that it occurs on that day (apogee,

declination maximum, eclipse). That will also let us finally be able to set

up day trading models with higher accuracy as then we can better predict the

days\' range and open in regards to the range as a relative percentage, etc.

A person selects all the events they want, presses CALCULATE, the ephemeris

is backchecked to create the data set, then the regression is done and

outputed, and you have the opton of doing it again or plotting the model

results.

Once the model is computed, I want t-statitsics computed and R-squared, so

I can get rid of insignificant variables. That information alone would help

me build other traditional models, especially if I run both equations to see

what variables are significant for model inclusion. This model will help us

DROP OUT insignificant variables in other mdoels which are overwhelming the

neural nets with too much data input.

I would run it once for the moon to see what variables/angles are

significant, then drop the insignifcant variables and see if the new model

is better, etc. and then do for each planet in turn. After running each

planet I\'d be able to greatly get rid of insignificant variables and reduce

the size of neural net models to what is significant, or just combine the

planet info together to create a bigger o\\model.

It would also be able to plot the predictions into the future since it has

the price change predicted for each day. This is far superior to the Carol

Mull early work.

===============================

8. If you program up the (0,1) variables/events, then you can create a

Probabilistic Neural net for classifiers, which can work for identifying

large range days, etc. This would be yet another option, as this is the best

method for predicting classes of objects, not clustering.

==============================

9. I want a (SUN ) Light Model, which is similar to the gravitaition effect

model, which represents the light reaching us on earth from a planet after

originating from the sun. This will add an extra degree of nonlinearity int

he model which we want. In Timing Solution, the gravitation effect is

computed as 1/(geo distance**2) whereas we want 1/(geo + helio distance)**2.

Since the Sun may be considered as the battery or power generator of the

system, I want the following options...

Effect = (1 * Phase * Mass )/[(Sun-planet helo dist + planet-earth geo

dist)**2]

Phase is optional (either 1 or the actual disc illumination for sunlight

from the planet reflecting and reachign earth)

Mass is optional (either Size of disc or Mass or planet or 1)

This measure, for each planet, will give the strength of reflected sunlight

reaching the earth from the planet.

If there was some option where I could even combine all the effects for

moon, mercury, venus, etc. into one equation or neural net input, that would

be cool. This would enable you to predict the net vector of all such light

reaching the earth from planets (and biasing them by mass or disc size or

whatever if you think each planet gives off different types of energy like

fire, water, air, etc) since you\'re squaring the distance traveled byt he

light (it falls off as 1/d**2). You could modify the strength of that light

by the phase or fraction illumination of each planet disc, and even the size

of the disc or MASS of the planet if that was an option though these being

constants would naturally fall oout in any model naturally.

I honestly believe this model will provide some big breakthroughs.

e-Mail: Sergey

.

Date 24th 2007f November 2007

Upcoming events -> true range

e-Mail: David Sloan

.

Date 26th 2007f November 2007

1. When NN profit tab is chosen and optimize button selected, is there a

way to have the LBC moved up every X days and profit calculated from

that? It appears now that profit is calculated now from the original LBC

point. But in reality with trading, I would retrain the NN by moving the

LBC every X days (X = 1 or maybe 5 if doing once per trading week). This

would then adjust the NN for the testing period and very likely create

new buy/sell signal dates. So what I\'m asking is, is there a way to

calculate profit based on this format? At first thought, this would seem

to be the more accurate method for backtesting profit.

2. When NNs are saved, then the program is opened another day and NNs

recalculated, the NN name is no longer there. It just says \"Neural Net

2\" etc. It would be nice to see the original name for reference. I know

that you could look at the NN input and decipher, but it\'s still not

clear even then.

e-Mail: Al Bidinger

.

Date 27th 2007f November 2007

In anticipation of printing out charts using your software, I have purchased an HP Plotter that can make 4 foot x 120 foot stock charts :-)

Now, my question to you: How difficult will it be to add a feature to TS so that it can print out ALL of the data and studies in memory instead of just what is shown on the screen.

In other words, if I have 50 years of Dow data with overlayed neural net projections, etc., can I get TS to send the whole 50 years of data to my plotter or do I have to cut and paste each

screen shot?

Is it possible to add a feature in TS where a continuous chart could be produced?

e-Mail: Benedict Goette

.

Date 27th 2007f November 2007

how can I save this model attached to the chart (Bradley Barometer), in a panel below the main chart ?

e-Mail: Robert Rundle

.

Date 29th 2007f November 2007

Hi Sergey,

Some more suggestions for TS, add to wish list folder;

�

A �TS Site Map�. So Users can find pacific articles without

having to email �Where is This?� What is link for Square 9

update?

�

Undo, or Remove Tool. How to remove say Committee Lines on chart?

�

A warning box like the �incorrect data box� for �last bar is

not today�s date� or �data not updated� (should be yesterdays date if

updated daily).

�

Plot Square 9 & 12 (standard static lines based from 1). With

Properties box to plot only in inclusive dates or price range. I.e. between

$1.00 and $2.00.

�

On existing Square 9 function � a function in Properties

box to plot lines within a price range. I.e. 3 levels above and below this XYZ

price.

�

Add Square of 12 (or is that reserved for TS 2?)

�

A �Distribution in Price % Heat Map� with options to select a

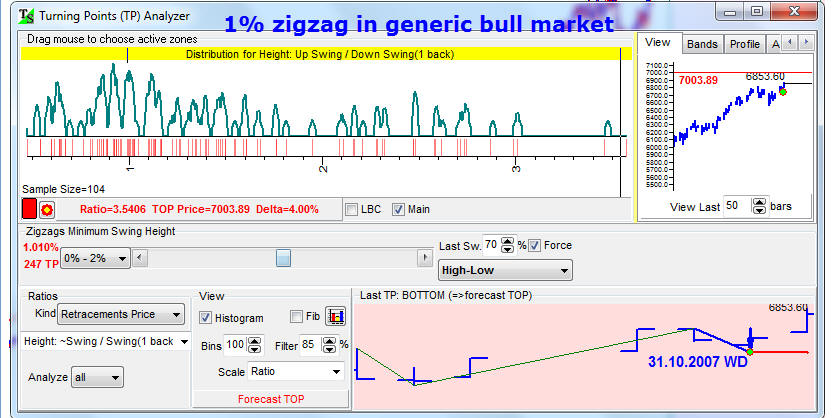

given period or range. Basic example in picture below. But do as a histogram

more accurately than this picture. You may be able to incorporate it into the

�Turning Points Analyser� Solution.

e-Mail: Sergey

.

Date 29th 2007f November 2007

Upcoming Events -> True Range -> nonparametrick statistical criteria

e-Mail: Sergey

.

Date 29th 2007f November 2007

In composite -> min amount of cyces for B interval

e-Mail:

.

Date 07th 2007f December 2007

Generating Navamsa charts

e-Mail: Sergey

.

Date 19th 2007f December 2007

Adjustable MCAD

e-Mail: Peter Tryde

.

Date 19th 2007f December 2007

Hi Sergey,

The ephemeris generator is very useful, but it is hard to read

as the window display is in minisize only. Kindly fix the

function so one can enlarge the graph to full screen size.

Thanks.

Peter

e-Mail: Sergey

.

Date 24th 2007f December 2007

Weekly data

e-Mail: Nick

.

Date 28th 2007f December 2007

Also, is it possible when drawing the last wave to the LBC to have it as a true % move as far as price magnitude is concerned. This way when TS computes that wave it is using the exact amount of price difference from the end of the last wave to the LBC (and end of last price bar).

e-Mail: Benedict Goette

.

Date 03rd 2008f January 2008

I

would like to suggest that the following data should be included in the

Composite Report:

In

the header:

-

what was

the target index and its parameters

-

what was

the training, what was the verification data interval

for

each tested Aspect:

correlation with training interval

correlation with verification interval

It

would be great if the output could be generated into a HTML Table format, e.g.

with 3 columns:

Column

1: Picture / info that is currently contained

Column

2: Correlation w/ training interval

Column

3: Correaltion w/ verification interval

This

would be especially useful when copying to Excel and sorting / prioritizing the

data further.

Thank

you for considering.

e-Mail: from Venkat

.

Date 03rd 2008f January 2008

eMail file

e-Mail: Sergey

.

Date 04th 2008f January 2008

Weekend in Bar time

e-Mail: Sergey

.

Date 04th 2008f January 2008

ULE:Pattern Culmination

e-Mail: Sergey

.

Date 05th 2008f January 2008